The Ultimate Guide to Forex Trading Strategies, Tips, and Tools 1578211250

The Ultimate Guide to Forex Trading: Strategies, Tips, and Tools

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global marketplace. With a daily trading volume exceeding $6 trillion, it is one of the most liquid and fast-paced markets in the world. As you delve into the world of Forex, you will find a plethora of strategies, insights, and technical tools to help improve your trading skills. Whether you’re a beginner or an experienced trader, understanding the intricacies of this market can significantly enhance your profitability and trading experience. For a professional approach to trading, consider a reliable platform like trading forex Trading Broker ID.

Understanding the Basics of Forex Trading

Before embarking on your Forex trading journey, it is crucial to grasp some fundamental concepts. Forex trading revolves around currency pairs, where the value of one currency is measured against another. For instance, the EUR/USD pair indicates how many US dollars one can purchase with one euro.

The Forex market operates 24 hours a day, five days a week, allowing traders to engage in various time zones across the globe. Currency pairs are divided into three categories: major pairs, minor pairs, and exotic pairs. Major pairs include currencies from the world’s largest economies, while minor pairs involve currencies from smaller economies. Exotic pairs consist of a major currency paired with a currency from a developing economy.

Key Forex Trading Strategies

As you navigate Forex trading, it is essential to adopt effective strategies that suit your trading style. Here are some popular trading strategies:

1. Scalping

This strategy involves making quick trades to capitalize on small price movements. Scalpers aim to collect a small profit from each trade, making numerous transactions throughout the day. To succeed at scalping, traders must have a solid understanding of market trends and be able to make quick decisions.

2. Day Trading

Day trading involves opening and closing positions within the same day to avoid overnight risk. Day traders typically utilize technical analysis, chart patterns, and various indicators to make informed decisions. This strategy requires a commitment to monitoring the markets closely throughout the trading day.

3. Swing Trading

Swing traders hold positions for several days to capitalize on expected price moves. This strategy allows traders to take advantage of market swings while reducing the need for constant monitoring. Swing trading can be less stressful than day trading and is suitable for those who have other commitments.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years based on fundamental analysis. This approach relies on macroeconomic trends and the overall performance of a currency, making it less affected by short-term market volatility.

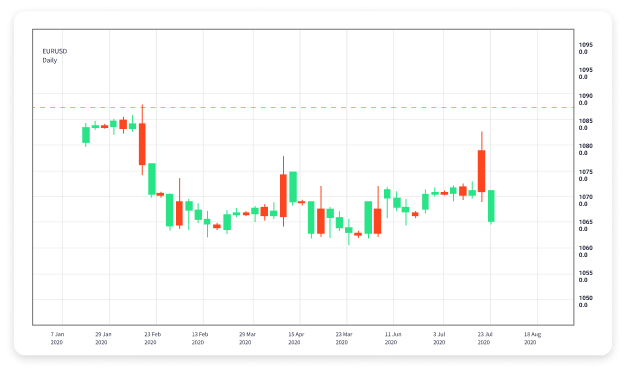

Technical Analysis in Forex Trading

Technical analysis involves studying historical price data and chart patterns to forecast future market movements. Traders use various tools and indicators to analyze price trends, including:

- Moving Averages: These indicators help smooth out price data to identify trends over a specified period.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: This tool consists of a moving average and two standard deviations to identify volatility and price levels.

- Fibonacci Retracement: This technique identifies potential reversal levels based on the Fibonacci sequence, helping traders identify entry and exit points.

Fundamental Analysis in Forex Trading

While technical analysis focuses on price movements, fundamental analysis examines economic indicators and news events that can influence currency values. Key factors include:

- Economic Indicators: Reports such as GDP, employment data, and inflation rates provide insight into a country’s economic health.

- Central Bank Policies: Decisions made by central banks, including interest rate changes, can significantly impact currency values.

- Political Events: Political stability and events like elections can create uncertainty, affecting market sentiment.

Risk Management in Forex Trading

Risk management is a critical aspect of successful Forex trading. Traders should establish a risk-reward ratio for each trade, set stop-loss and take-profit orders, and never risk more than a small percentage of their trading capital on a single trade. Effective risk management helps protect capital and prolong trading careers.

Choosing the Right Forex Broker

Choosing a reliable Forex broker can make a significant difference in your trading experience. Factors to consider include:

- Regulation: Ensure your broker is regulated by a recognized authority to protect your funds.

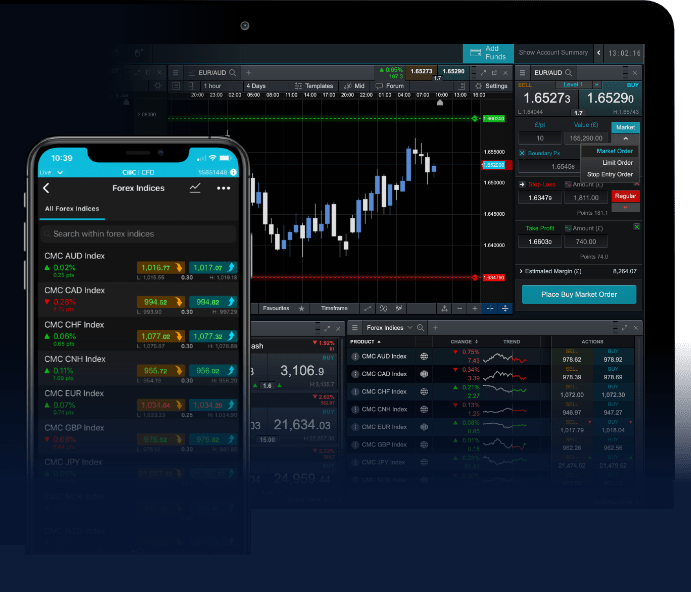

- Trading Platforms: Look for user-friendly platforms that provide the tools and features you need for effective trading.

- Spreads and Commissions: Compare spreads and commissions, as lower trading costs can improve profitability.

- Customer Support: Reliable customer support can help resolve issues quickly and efficiently.

Conclusion

Forex trading offers significant opportunities for traders willing to learn and adapt. By understanding fundamental and technical analysis, adopting effective strategies, and implementing sound risk management practices, you can improve your trading skills and potentially achieve long-term success in the Forex market. As you pursue your trading journey, remember that continuous education and practice are essential for developing a robust trading plan.

Whether you are just starting or looking to refine your strategies, the world of Forex trading has something for everyone. So equip yourself with the right tools and knowledge, and step into this dynamic market with confidence!